Transform Your Garage: A Comprehensive Guide to ADU Conversion Costs

In an era of escalating housing costs and evolving living arrangements,

accessory dwelling units (ADUs), often referred to as granny flats or

in-law suites, have emerged as a popular solution. Converting an existing

garage into an ADU presents a particularly appealing option for

homeowners seeking to maximize property potential while adding value and

flexibility. However, embarking on a garage conversion is a significant

undertaking that requires careful planning and a clear understanding of

the associated costs.

Factors Influencing Garage Conversion Costs

The cost of converting a garage into an ADU can vary significantly

depending on a multitude of factors. Understanding these variables is

crucial for establishing a realistic budget and avoiding unforeseen

expenses.

1. Location and Local Regulations

Geographical location plays a pivotal role in determining conversion

costs. Construction expenses, labor rates, and permitting fees can

fluctuate considerably from one region to another. Moreover, local

zoning ordinances and building codes impose specific requirements that

can impact the scope and cost of the project. Some areas may have

restrictions on ADU size, height, or parking provisions, while others

may offer incentives or expedited permitting processes.

2. Garage Size and Existing Condition

The size and existing condition of your garage are primary cost

determinants. A larger garage provides more square footage to work with,

potentially accommodating additional bedrooms, bathrooms, or living

areas, but will require more materials and labor. Similarly, a garage

in poor condition, requiring extensive repairs or structural

modifications, will increase overall expenses.

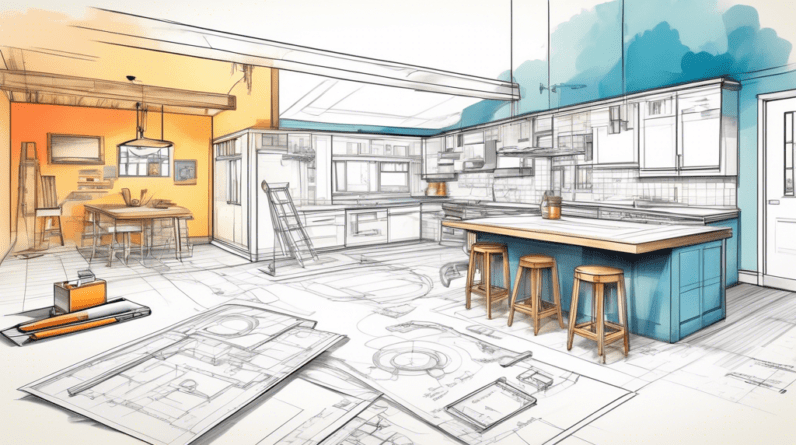

3. Conversion Complexity and Design Choices

The complexity of your desired ADU design and the level of finishes you

select will significantly impact costs. Basic conversions, involving

minimal structural alterations and standard fixtures, will be more

affordable than elaborate designs incorporating high-end appliances,

custom cabinetry, or luxury finishes.

Key Design Considerations:

-

Number of Bedrooms and Bathrooms: Adding bedrooms

and bathrooms typically constitutes a significant portion of the

budget, as it requires plumbing, electrical, and framing work. -

Kitchen and Appliances: Equipping a full kitchen

entails expenses related to cabinetry, countertops, appliances

(refrigerator, stove, oven, dishwasher, microwave), plumbing

fixtures, and electrical outlets. -

Flooring, Walls, and Ceilings: The choice of

flooring materials (tile, hardwood, carpet), wall finishes

(paint, wallpaper, wainscoting), and ceiling treatments

(drywall, exposed beams, tray ceilings) can significantly

influence costs. -

Lighting and Electrical: Adequate lighting is

crucial for an ADU, and expenses will depend on the number and

types of fixtures (recessed lighting, pendant lights, sconces),

as well as the need for additional outlets and circuits. -

Plumbing and HVAC: Connecting to existing water

and sewer lines or installing new ones, as well as integrating

with the main house’s HVAC system or adding a separate unit,

represents a substantial expense. -

Windows and Doors: The number, size, and type of

windows and doors (single-pane, double-pane, energy-efficient)

affect both material costs and energy efficiency. -

Insulation and Ventilation: Proper insulation

and ventilation are essential for energy conservation and

occupant comfort.

4. Labor Costs

Labor costs typically constitute a significant portion of the overall

conversion budget, varying depending on the scope of work, local labor

rates, and the expertise of the professionals involved. It’s essential

to obtain multiple quotes from reputable contractors and subcontractors

(electricians, plumbers, HVAC technicians) to ensure competitive

pricing.

5. Permits and Inspections

Obtaining the necessary permits and scheduling inspections is a crucial

aspect of any garage conversion project. Permit fees vary by

jurisdiction but can range from a few hundred to several thousand

dollars. Inspections ensure that the construction work complies with

building codes and safety regulations.

6. Unexpected Issues

As with any renovation project, unforeseen issues can arise during a

garage conversion. These might include hidden structural damage,

outdated electrical wiring, or plumbing problems, all of which can lead

to budget overruns. Setting aside a contingency fund (typically 10-20%

of the estimated project cost) is advisable to address unexpected

expenses.

Estimated Cost Breakdown

While actual costs will vary depending on the factors outlined above,

here’s a general breakdown of typical garage conversion expenses:

| Category | Estimated Cost Range |

|---|---|

| Design Fees (Architect, Designer) | $1,000 – $5,000+ |

| Permits and Inspections | $500 – $3,000+ |

| Demolition and Site Preparation | $1,000 – $3,000+ |

| Foundation and Framing | $5,000 – $15,000+ |

| Plumbing | $2,000 – $10,000+ |

| Electrical | $3,000 – $8,000+ |

| HVAC | $3,000 – $10,000+ |

| Insulation | $1,000 – $3,000+ |

| Drywall and Painting | $2,000 – $5,000+ |

| Flooring | $1,500 – $4,000+ |

| Windows and Doors | $2,000 – $6,000+ |

| Kitchen Cabinets and Countertops | $3,000 – $10,000+ |

| Appliances | $2,000 – $8,000+ |

| Bathroom Fixtures | $1,500 – $5,000+ |

| Lighting | $1,000 – $3,000+ |

| Contingency Fund (10-20%) | $5,000 – $15,000+ |

| Total Estimated Cost | $35,000 – $100,000+ |

Financing Options

Financing a garage conversion project requires careful consideration.

Several options are available, each with its own terms and implications:

-

Home Equity Loan or Line of Credit (HELOC): Using

your home’s equity as collateral, these options offer a lump sum

or revolving credit line at competitive interest rates. -

Cash-Out Refinance: This involves refinancing your

existing mortgage for a larger amount, allowing you to access

cash for the conversion. -

Personal Loan: Unsecured personal loans offer

flexibility but typically come with higher interest rates. -

Construction Loan: Specifically designed for

construction projects, these loans provide funds in draws as

work progresses. -

Government Programs: Explore local or state

programs that offer incentives, grants, or low-interest loans

for ADU construction.

Maximizing Your Return on Investment

While a garage conversion can be a significant financial investment, it

also presents an opportunity to enhance property value and generate

rental income:

-

Increased Property Value: A well-designed and

constructed ADU can significantly boost your property’s market

value, providing a substantial return on investment when you

decide to sell. -

Rental Income Potential: Renting out your ADU can

generate a steady stream of passive income, helping to offset

mortgage payments or other expenses. -

Flexible Living Arrangements: ADUs provide

flexible living spaces for extended family members, aging

parents, or adult children seeking independence.

Conclusion

Converting your garage into an ADU offers a compelling solution for

increasing living space, accommodating loved ones, and maximizing

property potential. By carefully considering the factors influencing

costs, establishing a realistic budget, and exploring financing options,

you can embark on a transformative project that enhances your lifestyle

and financial well-being.